Life Insurance & Life Insurance Policies at InsuranceLife Pro!

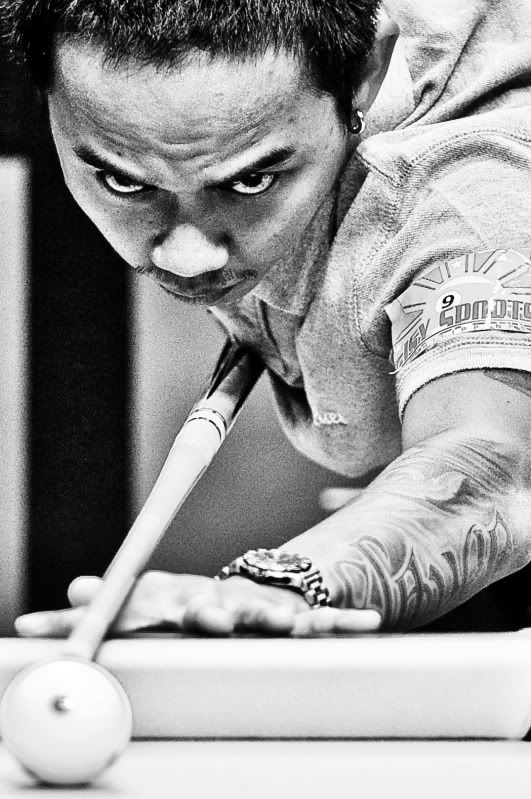

Noel Andoque, a billiards buddy, wants to know more about life insurance and life insurance policies. My pool player friend has been hearing about such for quite some time and would like to know exactly what life insurance is. To help him out, I browsed the internet computer network using the phrase – what is life insurance - and found a site that answers it all, InsuranceLife.pro.

Noel Andoque, a billiards buddy, wants to know more about life insurance and life insurance policies. My pool player friend has been hearing about such for quite some time and would like to know exactly what life insurance is. To help him out, I browsed the internet computer network using the phrase – what is life insurance - and found a site that answers it all, InsuranceLife.pro.

From what I could gather at InsuranceLife.pro, life insurance is known as life assurance - the contract between the policy owner and the insurer. The insurer agrees to pay a certain amount of money, which would be provided to the insured or their family, in case of death or similar events. Such insurance claims may also include terminal illness or critical illness. In return of the amount paid by the insurer, the policy owner has to pay a stipulated amount of money which is called a premium. The premiums are payable at regular intervals or in lump sums. And did you know that some insurance companies also have options of paying for catering and other after funeral expenses? Yes, such options exist.

Now, with regards to choosing a life insurance company, there are a number of options. What is very important is that new policy seekers and prospective life insurance clients find life insurance firms with good records. And how to determine which life insurance companies are good? One way is to examine their records via accreditations. Choosing a company that has good accreditations from different federal sources aids the public in minimizing the chances of frauds and hoaxes. And it goes without saying that the chances of getting claims are almost assured if they are proved to be genuine. Thus, it is of vital importance that a good insurance company should be chose for life insurance. And I kid you not!

For more life insurance-related questions and all, visit InsuranceLife.pro. It is one good resource!

0 comments:

Post a Comment